Exploring the Best Mortgage Options in San Ramon

If you’re planning to buy a home in San Ramon, understanding your mortgage options is one of the most important first steps. With choices like fixed-rate loans, adjustable-rate mortgages (ARMs), and government-backed programs, selecting the right fit depends on your goals and financial situation. Knowing what’s available can help you navigate the San Ramon real estate market with confidence and clarity.

Must-Read Alert: While you're here, you might want to check out Home Staging Transformations in San Ramon. It’s gaining serious traction — and can help boost your property's appeal before you list!

Understanding the Main Mortgage Options

When exploring mortgage options for San Ramon buyers, it helps to understand the types of loans available.

Fixed-Rate Mortgages

Fixed-rate mortgages keep the same interest rate and monthly payment over the life of the loan. They’re great for long-term buyers who want stable payments and predictability.

Adjustable-Rate Mortgages (ARMs)

ARMs start with lower interest rates for a set period, usually 5 to 7 years, before adjusting annually. This option might suit buyers who plan to move or refinance before the rate changes. You can learn more about how ARMs work in this Investopedia guide to Adjustable-Rate Mortgages, which breaks down the pros, cons, and common terms.

Government-Backed Loans

FHA and VA loans offer support for qualified buyers. FHA loans are popular among first-time buyers because of their lower credit and down payment requirements. VA loans, available to veterans and active-duty service members, offer competitive terms and no down payment.

Evaluating Your Financial Situation

Before applying for a home loan, it’s important to understand your financial health.

Income and Expenses

Keep monthly housing costs (including your mortgage) under 28% of your gross income. This helps ensure long-term affordability.

Down Payment Goals

A 20% down payment can help avoid private mortgage insurance (PMI), which increases your monthly cost. If that's not possible, some mortgage options allow as little as 3.5% down.

Also, avoid common slip-ups by reviewing these first-time buyer mistakes to avoid in San Ramon. Learning from others can save you stress and money.

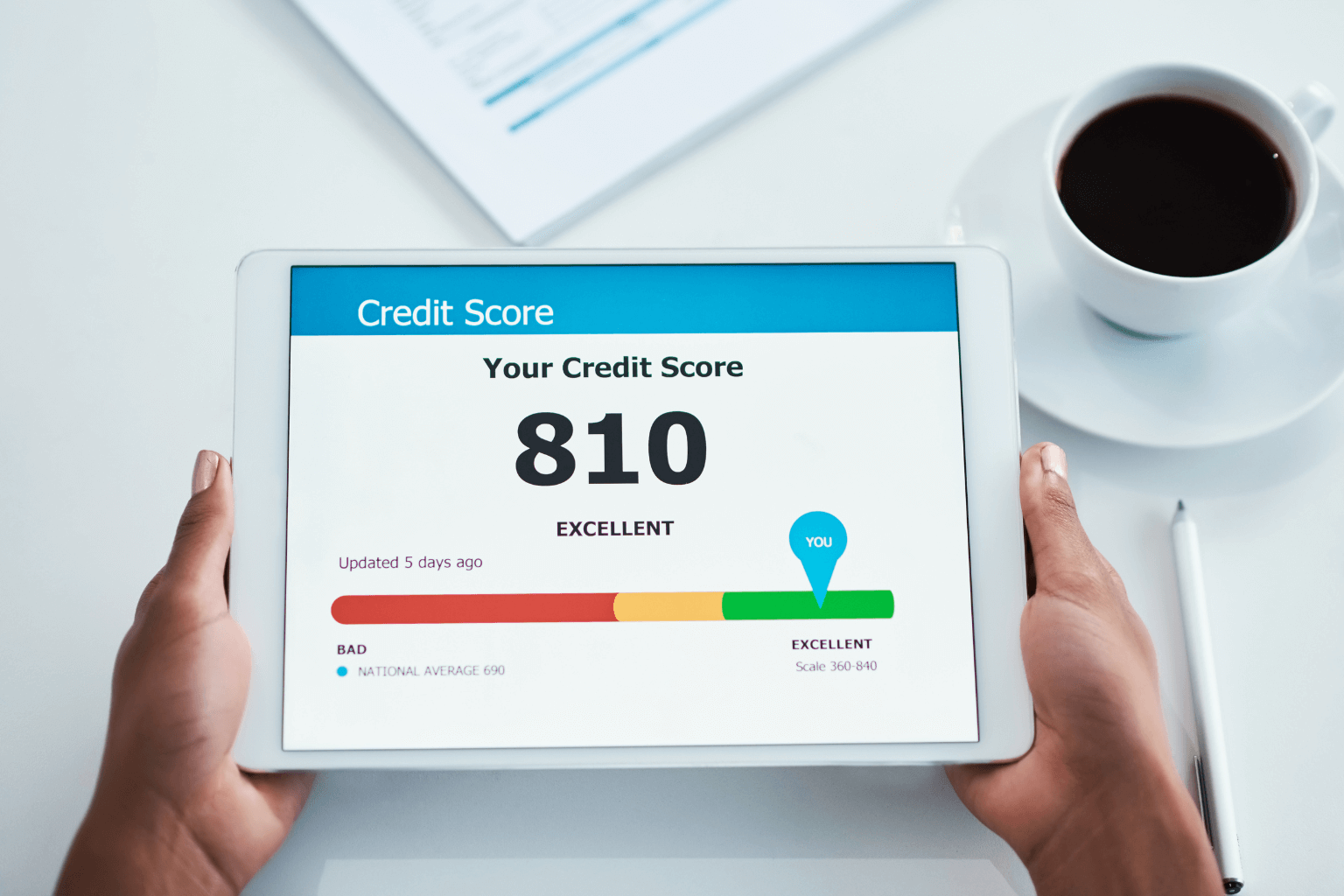

The Importance of a Strong Credit Score

Your credit score plays a big role in the kind of mortgage you can get—and the interest rate you’ll pay.

- Scores above 740 typically get the best mortgage rates.

- Pay bills on time, reduce debt, and check your credit report for errors.

- Avoid new credit lines before applying for a mortgage.

A better score can unlock more favorable mortgage options for San Ramon buyers. According to Experian, one of the top credit reporting agencies, a "very good" score can drastically reduce borrowing costs over time.

Comparing Mortgage Lenders

Rates and fees vary between lenders, so comparing is key.

Shop Around

Get at least three quotes from banks, credit unions, or mortgage brokers. Compare interest rates, closing costs, and loan terms.

Pre-Approval Benefits

Getting pre-approved shows sellers you’re serious and helps you understand how much you can borrow based on your financial profile.

Strategies to Secure the Best Terms

Here’s how to put yourself in a strong position when choosing a mortgage:

- Improve your credit score before applying.

- Save for a larger down payment to lower your loan amount.

- Choose between fixed and adjustable-rate loans based on your plans.

- Work with local experts who understand the San Ramon real estate market.

Conclusion

Choosing the right mortgage options for San Ramon buyers doesn’t have to be confusing. By learning about different loan types, evaluating your finances, and comparing lenders, you can make informed choices that match your goals. With a strong credit score and smart planning, homeownership in San Ramon is within reach.