Understanding Mortgage Options in Orinda

Buying a home in Orinda, California, is an exciting step, but finding the right financing can feel overwhelming. This guide to mortgage options for Orinda buyers breaks down the most common loan types and programs available in Contra Costa County. With Orinda’s competitive real estate market and proximity to San Francisco and Oakland, being prepared with the right mortgage can make all the difference.

Hot Topic You Might Love: “If you're enjoying this, don’t miss our latest post — Home Seller Mistakes in Orinda. It’s getting attention and might just surprise you.”

Understanding Mortgage Types

When exploring the Orinda, CA housing market, it’s important to understand the loan options available:

- Conventional Loans – Require as little as 3% down for qualified buyers with strong credit.

- FHA Loans – A popular choice for first-time buyers, requiring just 3.5% down.

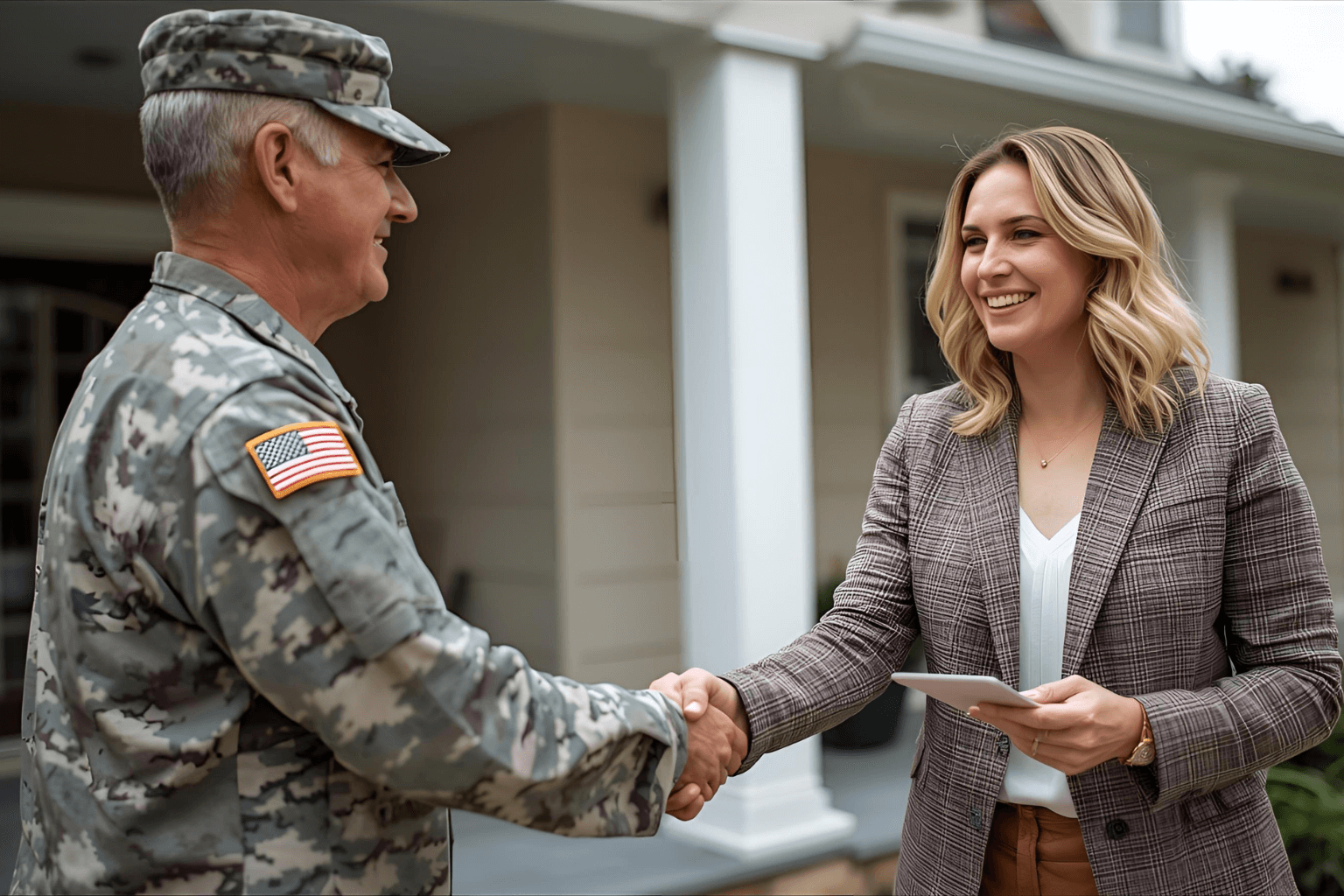

- VA Loans – Provide no down payment and no PMI for veterans and active-duty military.

- Adjustable-Rate Mortgages (ARMs) – Start with lower rates but can adjust over time.

- Renovation Loans (FHA 203k) – Bundle the cost of a home purchase with renovations.

Knowing these options helps Orinda buyers secure the best possible mortgage rates in Contra Costa County. For more details, see Investopedia’s overview of mortgage types.

Low Down Payment Options

In a high-cost Bay Area city like Orinda, saving for a large down payment can be challenging. Thankfully, several low downpayment mortgage options are available:

- FHA Loans – 3.5% down with flexible credit requirements.

- Conventional 97 Loans – Just 3% down for buyers with a 620+ credit score.

- VA Loans – Zero down payment for eligible veterans.

- USDA Loans – 0% down for homes in qualifying rural parts of Contra Costa County.

These programs make entering the Orinda real estate market more accessible, especially for first-time buyers.

Government-Backed Loan Programs

Government-backed loans are a strong option for buyers in Orinda who want flexibility or need assistance qualifying:

- FHA Loans – Low down payment and easier credit standards.

- VA Loans – 100% financing and no PMI for service members.

- USDA Loans – Affordable financing for homes in designated rural zones within Contra Costa County.

These programs provide reliable paths to homeownership in Orinda, even in a competitive market. To learn more about VA loans, the U.S. Department of Veterans Affairs provides eligibility details and resources.

The Importance of Pre-Approval

In Orinda, where homes often sell quickly and above asking price, pre-approval is essential. With pre-approval:

- Buyers know exactly how much they can afford.

- Offers stand out in the Bay Area real estate market.

- Potential financial issues are discovered early.

This step strengthens your position when competing for homes in Orinda’s desirable neighborhoods.

Tips for First-Time Homebuyers in Orinda, CA

If you’re buying your first home in Orinda, keep these tips in mind:

- Explore Programs: FHA, VA, and USDA loans can lower upfront costs.

- Use Down Payment Assistance: California programs, such as the CalHFA MyHome Assistance Program, help reduce out-of-pocket expenses.

- Stay Educated: Attend local first-time homebuyer workshops in Contra Costa County to better understand financing and market conditions.

These strategies will prepare you to navigate the Orinda, CA housing market with confidence.

Conclusion

This guide to mortgage options for Orinda buyers shows that purchasing a home in Orinda, CA, doesn’t have to be overwhelming. From FHA and VA loans to conventional and USDA programs, there are financing solutions to fit different needs. With pre-approval and the right guidance, Orinda buyers can successfully compete in Contra Costa County’s fast-moving housing market and secure the home that fits their lifestyle.