Top Homebuying Tips for First-Time Buyers in Walnut Creek

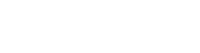

Walnut Creek is a beautiful place to call home, but buying your first house here can come with challenges if you're not prepared. From skipping pre-approval to underestimating total costs, several common first-time buyer mistakes in Walnut Creek can delay or complicate your journey to homeownership. Whether you're drawn to the area's top-rated schools or vibrant downtown, it's essential to approach the process with the proper knowledge. In this post, we'll break down the most frequent mistakes first-time buyers make and show you how to avoid them with confidence.

Why First-Time Buyers in Walnut Creek Face Unique Challenges

With its top-rated schools, scenic neighborhoods, and strong housing market, Walnut Creek is a sought-after location for new homeowners. But competition is fierce, and prices can climb quickly. That's why avoiding typical mistakes is key when buying your first home here.

Let's break down what to avoid and what to do instead.

Hot Topic You Might Love: While you're here, you might want to check out our post on Affordable Homes in Walnut Creek, CA. It’s gaining serious traction and filled with practical insights for smart home shoppers.

Mistake #1 – Not Getting Pre-Approved Early

Before house hunting, getting pre-approved for a mortgage should be your first step. One of the biggest first-time buyer mistakes in Walnut Creek is starting the search without knowing your real budget.

Why Pre-Approval Matters

Pre-approval shows sellers you're serious and financially ready. In a hot market like Walnut Creek, homes often receive multiple offers. If you're not pre-approved, you risk missing out.

Not sure what the difference is between prequalification and preapproval? The Consumer Financial Protection Bureau explains that preapproval typically involves verification of income and credit, giving sellers more confidence in your offer.

Pro Tip

Meet with a lender early to lock in your price range and gain an edge over other buyers.

Mistake #2 – Underestimating the True Costs

Many new buyers focus only on the down payment, but that's just one piece of the puzzle. You also need to account for:

- Closing costs (3%–5% of the purchase price)

- Property taxes and insurance

- Maintenance and unexpected repairs

- Moving expenses and utility setup

Skipping this financial planning step is one of the most common home-buying tips Walnut Creek experts advise against. As highlighted by the National Association of Realtors, thoughtful preparation, whether it’s budgeting or even staging, can lead to stronger offers and smoother sales.

Mistake #3 – Skipping the Home Inspection

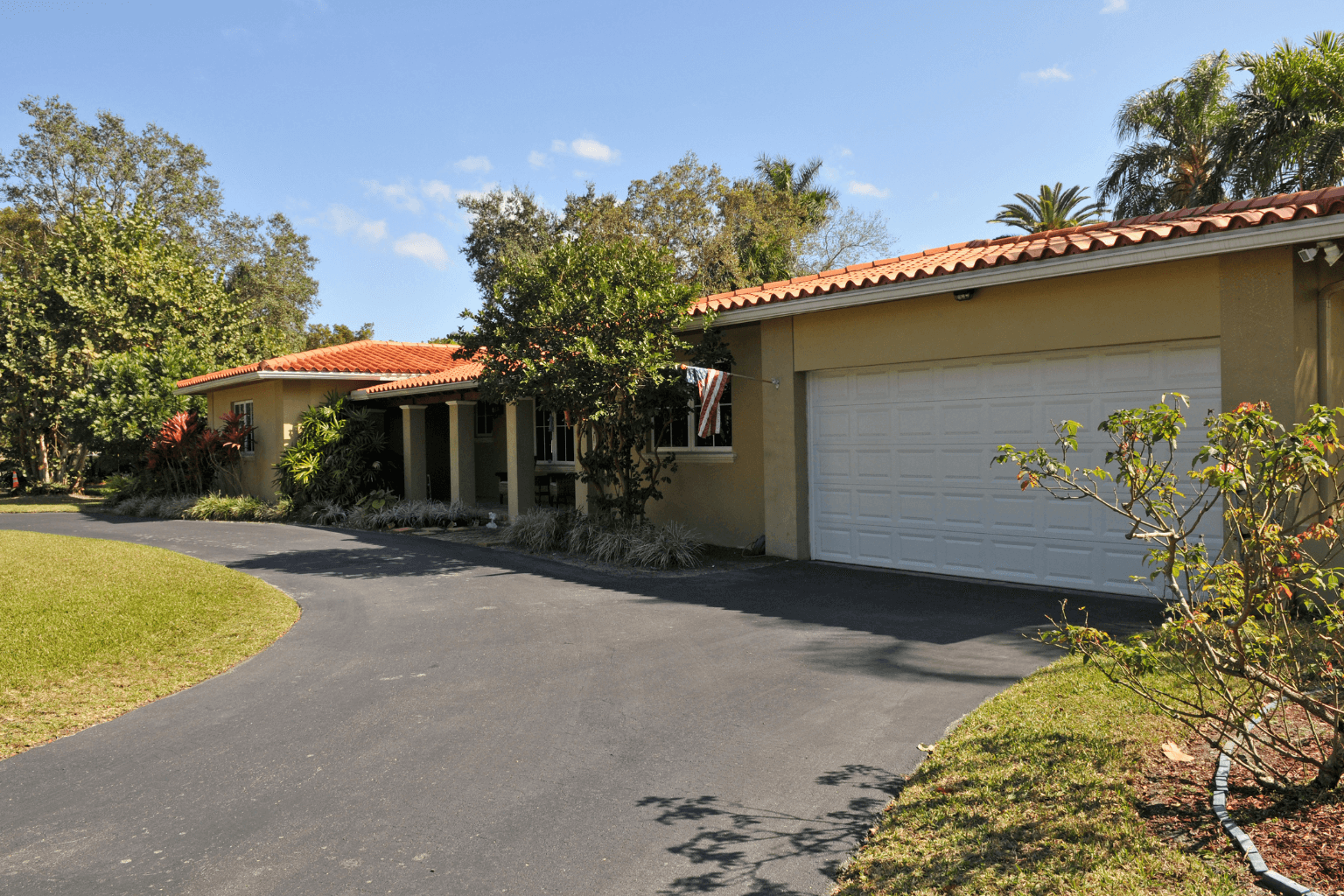

Trying to save a few hundred dollars by skipping the inspection can cost you thousands later. This is especially risky in Walnut Creek, where older homes may have hidden issues like:

- Foundation cracks

- Roof damage

- Outdated wiring or plumbing

Always Inspect Before You Buy

A thorough home inspection protects your investment and gives you the power to negotiate repairs or walk away if needed.

Mistake #4 – Not Researching the Neighborhood

Choosing the right home goes beyond four walls. First-time buyers in Walnut Creek often overlook the importance of local research.

What to Look Into:

- School quality (affects both value and lifestyle)

- Traffic patterns and commute times

- Noise levels at different times of day

- Local parks, shopping, and restaurants

- Community vibe and future development plans

Spend time exploring different areas to see which fits your lifestyle best.

Mistake #5 – Choosing the Wrong Real Estate Agent

Hiring the right real estate agent is crucial when buying your first home. Avoid relying solely on online reviews or choosing the first agent you meet.

What Makes a Good Agent?

- Local market knowledge of Walnut Creek

- Strong communication and negotiation skills

- Honest and client-focused approach

Interview multiple agents and ask for referrals. A knowledgeable agent helps you avoid pitfalls and get the best deal possible. Consider working with a buyer’s agent who specializes in Walnut Creek and understands the nuances of this market.

Final Thoughts

Avoiding the most common first-time buyer mistakes in Walnut Creek can make your path to homeownership much more manageable and far less stressful. By getting pre-approved early, planning for all the actual costs of buying, scheduling a home inspection, researching neighborhoods carefully, and working with a trusted local real estate agent, you can make smart, informed decisions every step of the way. Buying your first home in Walnut Creek should be an exciting milestone, not a frustrating experience. With the proper guidance and preparation, you'll be well on your way to finding a home you love in a community that fits your lifestyle.