Practical Advice for First-Time Homebuyers in Orinda

Buying your first home is a big milestone. Still, it's easy to make mistakes, especially in a competitive market like Orinda. Many first-time home buyers in Orinda jump in without being fully prepared, leading to costly delays or missed opportunities. Common issues include skipping mortgage preapproval, ignoring inspection contingencies, or taking on more home than they can genuinely afford. In this guide, we'll highlight the most common first-time buyer mistakes in Orinda and how to avoid them, so you can make smart, confident decisions and enjoy a smoother path to homeownership.

Must-Read Alert: While you're here, you might want to check out Buying a Home in Orinda. It’s gaining serious traction and offers more insight into navigating the Orinda market like a pro.

Top First-Time Buyer Mistakes in Orinda

Not Getting Mortgage Preapproval

One of the biggest first-time buyer mistakes in Orinda is house hunting without mortgage preapproval. A preapproval letter shows sellers you're serious and financially ready. Without it, your offer might be ignored even if you love the home.The Consumer Financial Protection Bureau explains that a preapproval letter is a lender’s tentative commitment to lend, helping buyers stand out in competitive markets like Orinda.

Failing to Shop for Multiple Mortgage Rates

Many buyers accept the first loan offer they receive. But comparing at least three lenders can lead to better interest rates and lower fees. As a first-time buyer in Orinda, slight differences in your rate can save you thousands over the life of your loan. The Federal Trade Commission recommends shopping around and even offers worksheets to help compare quotes, all within a 45-day window that won’t hurt your credit score.

Not Working with a Real Estate Agent

One of the most overlooked first-time buyer mistakes in Orinda is going through the home-buying process alone. Many buyers assume they'll save money by skipping an agent, but that's rarely true. Working with a trusted real estate agent can help you save time, avoid legal missteps, and make better decisions.

Benefits of Working with a Real Estate Agent

- Local Market Knowledge: Agents understand Orinda's neighborhoods, pricing trends, and what sellers are looking for.

- Access to Pre-Market and Off-Market Listings: Many homes never hit public platforms. Agents give you early access.

- Expert Negotiation: They know how to write strong offers and negotiate repairs, price reductions, or closing costs.

- Guidance Through Every Step: From paperwork to deadlines, a good agent keeps you on track and stress-free.

- No Out-of-Pocket Cost: In most cases, the seller pays your agent's commission, so you get professional help for free.

Avoid the mistake of going it alone. A qualified agent is your advocate, ensuring you're protected, informed, and positioned to succeed in Orinda's housing market.

Buying More Home Than You Can Afford

It's tempting to stretch your budget for a home you love, but this mistake can lead to stress down the road. Stick to a monthly payment that fits your lifestyle, and aim for a debt-to-income ratio under 36%. Don't forget hidden costs like property taxes, HOA fees, and maintenance.

Tips to Stay Within Budget

- Be honest about your monthly expenses and lifestyle needs

- Include taxes, insurance, and utilities in your calculations

- Budget for emergency repairs or maintenance

- Keep a financial cushion for peace of mind

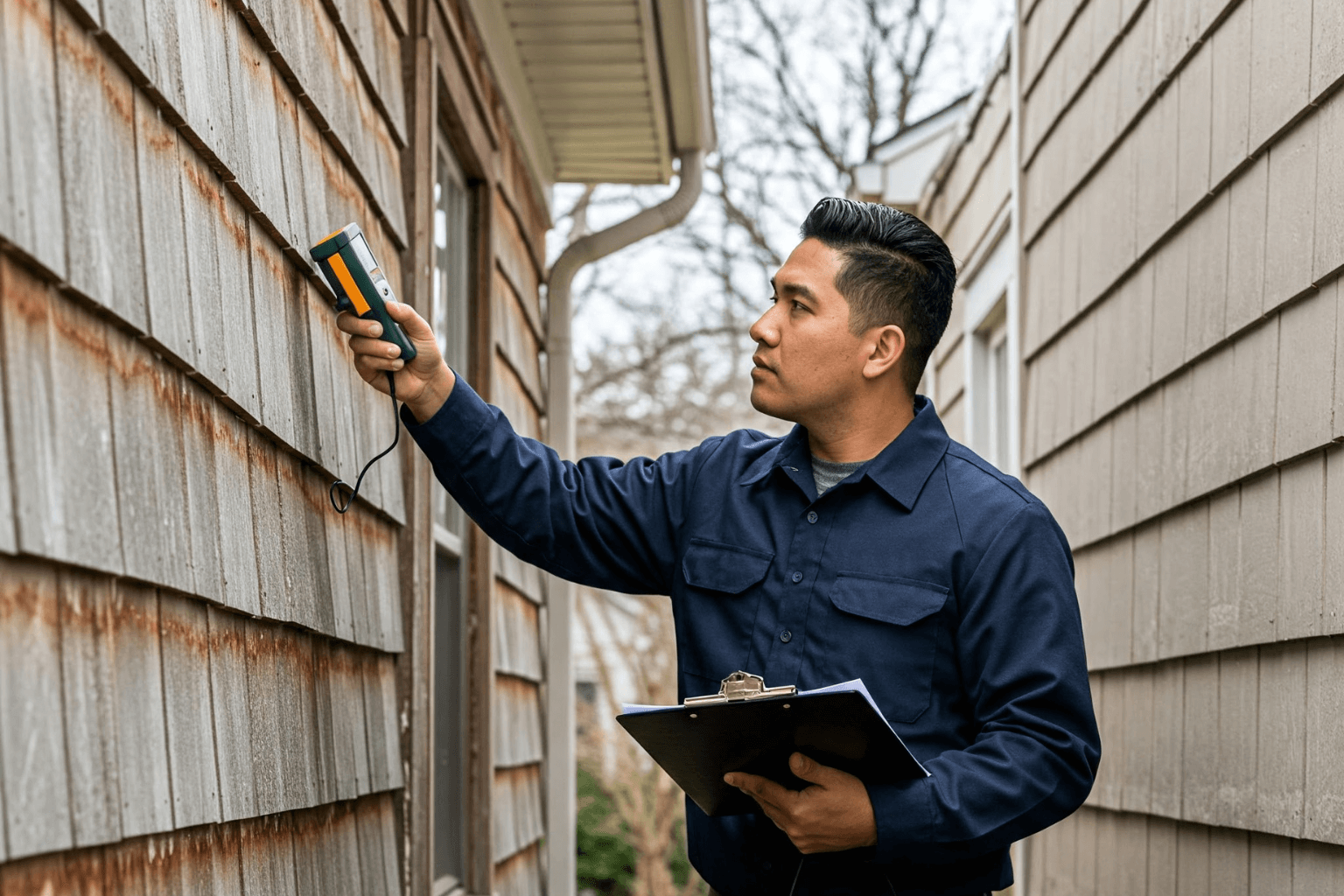

Waiving the Home Inspection

Another common first-time buyer mistake in Orinda is waiving the home inspection to speed up the process. This can backfire big time. Inspections often uncover serious (and expensive) problems. Spending a few hundred dollars upfront protects you from surprise repairs and gives you negotiating power.

Why You Should Never Skip the Inspection

- 86% of homes need at least one repair

- Inspections help you renegotiate or request repairs

- You gain peace of mind before committing

- Severe findings allow you to walk away without penalty

Orinda Home Buying Tips for First-Time Buyers

Here are a few quick tips to avoid mistakes and stay on track during your Orinda home search:

- Work with local professionals. They know Orinda's neighborhoods and pricing trends.

- Stick to your financial plan. A dream home isn't worth long-term debt.

- Ask questions at every step. From loan terms to inspection findings, clarity helps you make smarter choices.

Conclusion

Avoiding first-time buyer mistakes in Orinda can make all the difference between a smooth experience and a stressful one. From getting preapproved to staying within budget and never skipping inspections, small decisions can have a significant impact. Use these tips to buy smarter, protect your investment, and enjoy your journey to homeownership in Orinda. With the proper guidance and preparation, your first home can be a source of pride, not regret.