5 Common First Time Buyer Mistakes in Dublin, CA

Thinking about buying your first home in Dublin? It’s an exciting step, but it’s also easy to make avoidable errors. Learning how to sidestep first time buyer mistakes in Dublin, CA will save you time, money, and stress. In this guide, we’ll explore five common pitfalls new buyers often face and share simple ways to avoid them so you can move into your dream home with confidence.

Key Takeaways

- Research the Dublin, CA housing market before making any decisions.

- Be aware of hidden costs like closing fees, property taxes, and insurance.

- Get mortgage pre-approval early in the process.

- Stick to a smart budget and avoid overspending.

- Rely on professional guidance from real estate and financial experts.

1. Insufficient Market Research

Not understanding the Dublin housing market is one of the biggest first-time buyer mistakes in Dublin, CA you can make. Prices, school districts, and commute times can vary a lot from one neighborhood to another. If you’re not familiar with the area, take time to learn what fits your lifestyle and budget.

What to Look Into:

- Home prices in different parts of Dublin

- Local school ratings and community amenities

- Access to public transportation and freeways

- Trends in home values and new developments

Use local real estate websites and talk to area agents to get a complete picture before making a move.

Hot Topic You Might Love: If you're enjoying this, don’t miss our latest post — Drone View: Golf Course Properties in Dublin. It’s getting attention and might just surprise you.

2. Ignoring Hidden Costs

A common first time buyer mistakes in Dublin, California, is focusing only on the listing price. But many hidden costs can add up fast and catch you off guard.

Don’t Forget About:

- Closing costs: Usually 2%–5% of the purchase price

- Escrow and title fees

- Homeowners insurance and mortgage insurance

- Property taxes (especially in California)

- Repairs or updates after moving in

According to Investopedia, closing costs can be surprisingly high, and they vary depending on your loan and location. Budgeting for these extra expenses will help you avoid financial stress after you’ve moved in.

3. Skipping Mortgage Pre-Approval

One of the most preventable first time buyer mistakes in Dublin is starting your house hunt without a mortgage pre-approval. In a competitive market like Dublin, this can put you at a serious disadvantage.

Benefits of Pre-Approval:

- Helps you understand your price range

- Shows sellers you’re a serious buyer

- Speeds up the buying process once you make an offer

- Helps avoid disappointment when touring homes

Gather your pay stubs, tax returns, and credit information early to get started with a lender.

4. Overextending Your Budget

It’s easy to fall in love with a home that stretches your finances. Still, overspending is one of the most damaging first-time buyer mistakes in Dublin. Buying more than you can comfortably afford can lead to stress and long-term debt.

Budget Smart in Dublin:

- Set a maximum price and aim 10–20% below it

- Add in estimated taxes and insurance

- Consider future expenses like HOA fees or commuting costs

- Leave room for savings or unexpected repairs

Stick to your budget. It’s better to feel secure than stretched too thin.

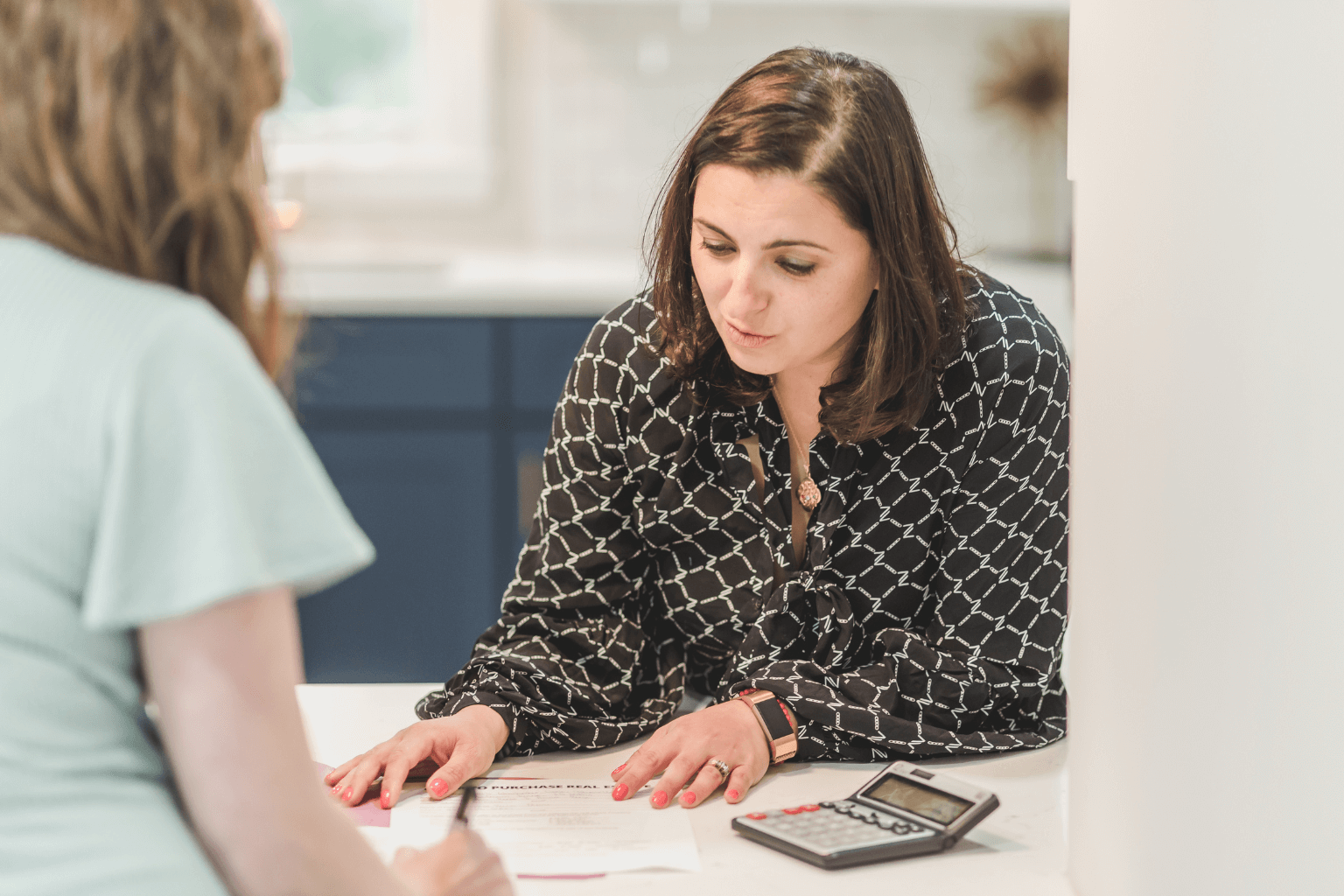

5. Neglecting Professional Advice

Trying to go it alone may seem like a way to save money, but neglecting expert advice is one of the most costly first time buyer mistakes in Dublin.

Who You’ll Need:

- Real estate agent: Helps you find the right property and negotiate

- Loan officer or mortgage broker: Finds the best loan options

- Home inspector: Spots hidden issues before closing

- Title and escrow professionals: Ensure your paperwork is accurate

- Real estate attorney (if needed): Helps with complex transactions

These professionals know the California home buying process inside and out. Don’t skip the support. They’re there to protect your investment.

Conclusion

Buying your first home in Dublin is an exciting milestone, but it’s easy to fall into traps if you’re not prepared. By avoiding these first time buyer mistakes in Dublin, CAlike skipping research, underestimating costs, or ignoring expert help, you’ll be in a stronger position to make smart, informed decisions.

Take your time, ask questions, and lean on trusted professionals. With the right strategy and support, you can enjoy the home-buying process and settle into the perfect place with confidence.