Helpful Advice for First-Time Homebuyers in Danville

Buying your first home can be exciting, but also stressful if you're not prepared. Many first-time buyers in Danville make avoidable mistakes that can delay or derail their journey. Whether it's skipping pre-approval or underestimating costs, the slightest misstep can have long-term consequences. In this post, we'll break down the most common first-time buyer mistakes in Danville and how you can avoid them.By making informed decisions, you'll feel more confident in navigating the Danville real estate market and finding the home that's right for you.

First-Time Buyer Mistakes in Danville to Watch Out For

Not Knowing How Much House You Can Afford

One of the biggest first-time buyer mistakes in Danville is jumping into house hunting without knowing your actual budget. It's easy to get attached to homes that are out of reach, which leads to disappointment or financial stress. Use a mortgage affordability calculator to estimate a safe price range, ideally one that keeps your mortgage payments under 28% of your gross monthly income.

Also, factor in hidden costs like property taxes, insurance, and utility bills. Speaking with a trusted local lender can give you a clearer picture of your financial boundaries. In a competitive California housing market, being realistic sets you up for success.

Skipping Mortgage Pre-Approval

Getting pre-approved for a mortgage is more than just paperwork; it's a powerful tool. Without pre-approval, you may waste time viewing homes you can't buy, or worse, lose out on your dream home to a more prepared buyer. Sellers in Danville are more likely to accept offers from buyers who already have financing lined up.

A pre-approval letter shows you're serious and ready. It can also speed up the closing process. Don't skip this step—it's one of the smartest things first-time homebuyers in California can do.

Ignoring the Home Inspection

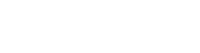

Many first-time buyers in Danville are tempted to waive the home inspection to make a faster or more appealing offer. But that's risky. Inspections can reveal problems that aren't obvious, such as plumbing issues, roof damage, or faulty wiring. A $400 inspection can save you thousands in repairs later.

More than just a safety net, inspection reports can also give you leverage to renegotiate the sale price or ask for repairs. It's a step worth taking in any real estate deal, especially in an area like Danville, where property values are high.

Underestimating the True Cost of Homeownership

Don't let your mortgage payment be the only number you consider. Homeownership comes with many other costs that can catch you off guard. These include homeowners insurance, property taxes, maintenance, and possible HOA fees. You'll also need to set aside money for unexpected repairs, experts suggest budgeting 1–2% of the home's value each year for upkeep.

In the Danville real estate market, knowing these costs upfront helps you plan better and avoid financial strain. It's about more than just buying a home; it's about keeping it.

Trending Now: While you're here, you might want to check out Best Dog-Friendly Parks Around Danville. It’s gaining serious traction — and a must-read for future homeowners with furry companions.

Rushing Through the Home Buying Process

Buying a home is a big commitment. It's easy to feel rushed in a hot market, but acting too quickly can lead to regret. First-time buyers often feel pressure to make fast offers without doing proper research. That can mean ending up in the wrong neighborhood or overlooking serious flaws.

Take the time to explore listings, visit different areas, and talk to your agent about local trends. Danville's neighborhoods offer a variety of vibes—don't settle until you find the one that fits your lifestyle.

If you’re working with a local expert, they can help you avoid this trap by showing you exactly what to look for. Here’s a peek into the day-to-day of a Danville Realtor—a good read if you want to understand how your agent works behind the scenes.

Final Thoughts

Avoiding first-time buyer mistakes in Danville can make your home-buying experience smoother and more rewarding. Stick to your budget, get pre-approved, never skip the inspection, and plan for all costs—not just the down payment. With a patient and informed approach, you can feel confident about your next move in the Danville real estate market.

Need help navigating the home-buying process in Danville? Talk to a local real estate expert to get personalized guidance tailored to first-time buyers like you.