How To Avoid Foreclosure in Walnut Creek CA

If you're facing the possibility of losing your home, you're not alone. Many homeowners are searching for ways to avoid foreclosure in Walnut Creek, CA, and fortunately, there are real solutions available. From loan modifications to legal protections, acting quickly can help you stay in control of your financial future. Let's explore the key steps, resources, and strategies that can help you protect your home and move forward with confidence.

Understanding Foreclosure and Your Options

Foreclosure doesn't have to mean the end of the road. Understanding your options can help you make informed decisions before it's too late.

Loan Modifications and Forbearance

One way to avoid foreclosure is through a loan modification, which can reduce your monthly payments or extend your loan term. Forbearance is another option that offers short-term relief by allowing you to pause or reduce payments temporarily.

According to Investopedia, a mortgage modification can help homeowners facing hardship avoid foreclosure by lowering monthly payments through reduced interest rates, extended terms, or other changes.

Short Sale or Deed in Lieu of Foreclosure

If keeping the home isn't possible, a short sale allows you to sell the property for less than what you owe, with lender approval. A deed in lieu of foreclosure can also release you from the loan by transferring ownership back to the lender.

Hot Topic You Might Love: If you're enjoying this, don’t miss our latest post — Affordable Homes in Walnut Creek, CA. It’s getting attention and might just surprise you.

Sell Your House Before Foreclosure

Another way to avoid foreclosure in Walnut Creek, CA, is to sell the home while it's in pre-foreclosure. This can prevent credit damage and help you move on without the legal and financial burden of foreclosure.

If you're thinking about selling and need expert help navigating the local market, connecting with the best buyer agent in Walnut Creek can make all the difference in securing a fair deal and a smooth transition.

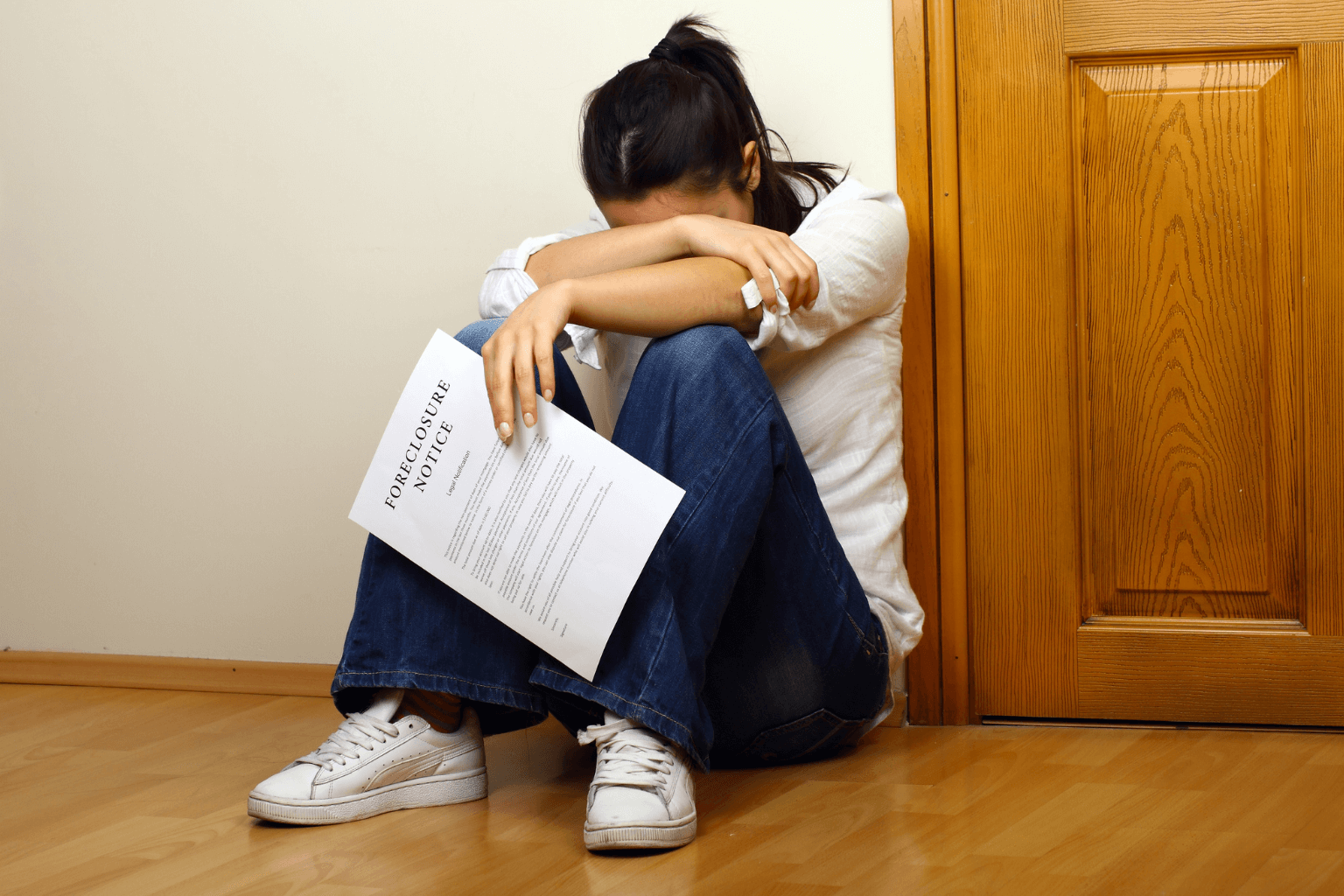

Immediate Steps After Receiving a Foreclosure Notice

When you receive a notice of default, time becomes your most valuable resource.

1. Contact a Foreclosure Attorney Immediately

Reach out to a Walnut Creek foreclosure attorney within 24–48 hours. Their guidance can help you understand your rights and take the proper steps quickly.

2. Gather All Mortgage Documents

Collect your loan paperwork, payment history, and correspondence with the lender. Having everything in one place will make legal consultations more effective.

3. Understand Your Rights

California’s Homeowner Bill of Rights offers protections that could delay or stop foreclosure. Know your rights before making any decisions.

Exploring Legal Alternatives to Foreclosure

Don't wait until it's too late. Exploring legal options can be the difference between saving your home and losing it.

Work with Your Lender

Some lenders offer loss mitigation programs such as repayment plans or modified loans. These programs can be initiated quickly if you act early.

File for Bankruptcy (as a Last Resort)

Filing for bankruptcy can temporarily stop foreclosure, but it's not for everyone. Consult a legal expert before considering this step.

Why Legal Help Is Crucial to Avoid Foreclosure in Walnut Creek, CA

Hiring a foreclosure attorney can improve your chances of keeping your home. Here's how legal experts support your fight:

- Negotiate better repayment terms

- Identify errors in foreclosure documents

- Protect your rights under California law

- Stop unlawful foreclosure processes

- Guide you through short sale or other options

How to Find the Right Foreclosure Attorney in Walnut Creek

When selecting a foreclosure attorney, consider the following:

- Check California Bar credentials and reviews

- Confirm experience with foreclosure cases

- Ask about fees and payment structures upfront

- Make sure they understand local and state laws

- Schedule a consultation to review your case

An attorney familiar with foreclosure laws in Walnut Creek, CA can offer critical guidance and improve your odds of a positive outcome.

Conclusion

Facing foreclosure can feel overwhelming, but you don't have to go through it alone. By understanding your options and acting quickly, you can avoid foreclosure in Walnut Creek, CA, and protect your financial future. Whether it's working with your lender, exploring legal alternatives, or selling your home before foreclosure, taking the proper steps now makes all the difference.

Don't wait! Reach out for help today and take back control of your home and your future.